This article introduces the X-Lifecycle Matrix (XLM), a new framework to provide a more accurate and analytical view of a product’s life than the traditional product lifecycle. For decades, the traditional Product Lifecycle (PLC) framework has been a foundational concept in marketing. However, in today’s fiercely competitive and fast-paced markets, its reliance on a time-based scale has become a significant limitation. The notion that every product will progress through a linear, time-bound journey has become a myth. To provide a more accurate and analytical tool, a new framework has emerged: the X-Lifecycle Matrix (XLM).

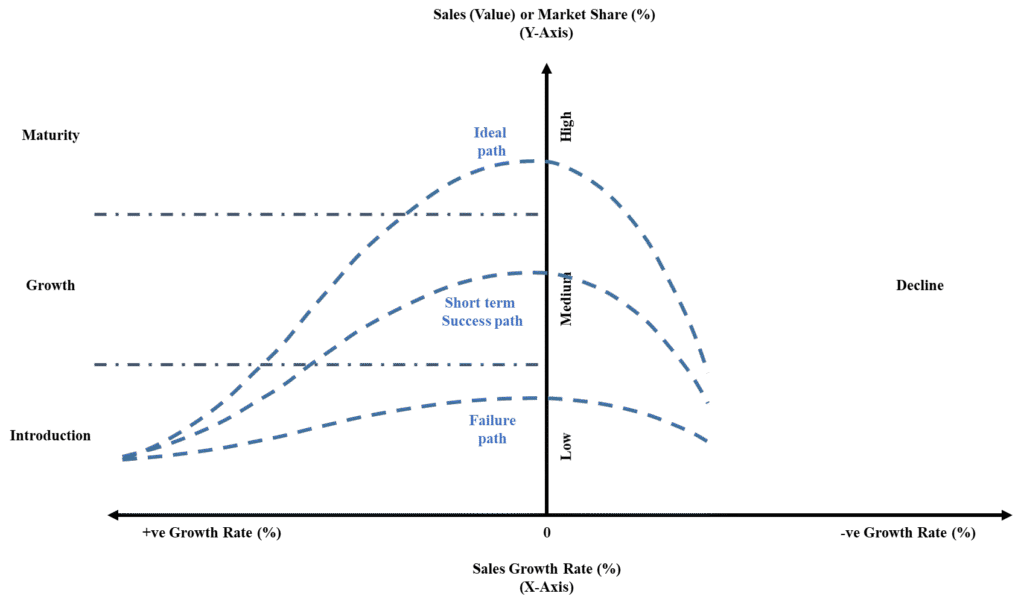

The XLM framework, a concept coined by Vikrant Bhongle and Team, represents a crucial upgrade to the conventional PLC. Its core innovation lies in the replacement of the ambiguous “Time” scale with a more meaningful and data-driven metric: Sales Growth Rate. By plotting Sales or Market Share on the Y-axis against the Sales Growth Rate on the X-axis, the XLM provides a powerful analytical lens that accurately reflects a product’s true status in the market, regardless of how long it has been in existence.

The 4-Stage XLM: A Foundation for Strategic Insight

The XLM begins with a modernized 4-stage framework that redefines the classic stages of the product lifecycle: Introduction, Growth, Maturity, and Decline. By using Sales Growth Rate, this model immediately provides a clearer picture than the traditional PLC. For example, a new product in its Introduction stage will be characterized by low sales but a high, positive growth rate, whereas a product in its Decline stage will have decline sales with a negative growth rate. This distinction is critical for business leaders, as it helps to avoid misinterpreting a temporary setback as a permanent decline.

This top-level XLM framework is invaluable for rapid, high-level analysis. It allows managers to quickly assess a product’s current standing, understand its trajectory, and make informed decisions about resource allocation and strategic focus.

Figure 1: 4-stage XLM and possible product journey paths

The 8-Stage XLM: Granular Analysis for Competitive Advantage

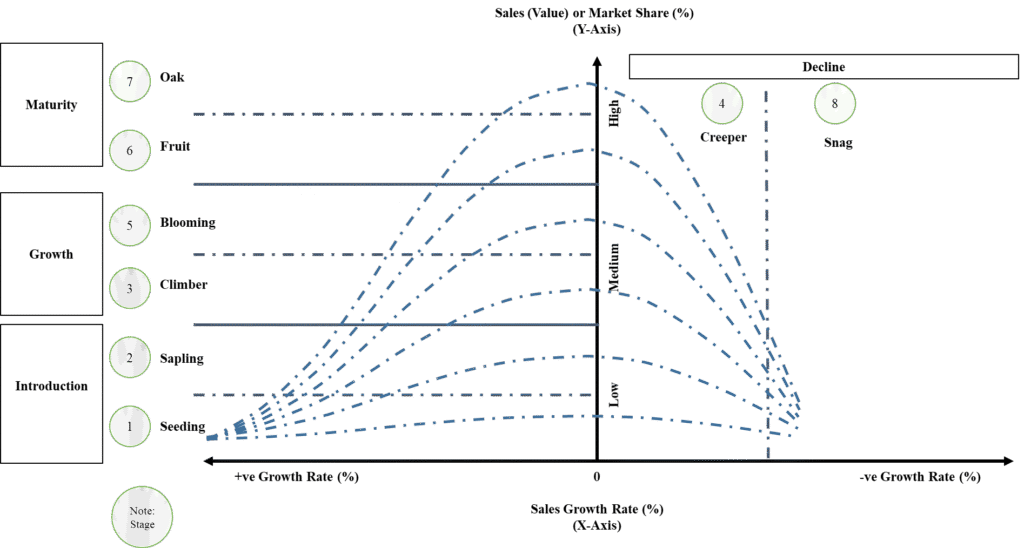

For a more granular and sophisticated analysis, the XLM framework expands into an 8-stage model, using a plant-based analogy to describe each phase of a product’s life. This detailed version provides a deeper understanding of market dynamics and is particularly useful for competitive benchmarking.

The 4-Stage XLM: A Foundation for Strategic Insight

Introduction: This phase is broken down into Seeding and Sapling.

- Seeding stage – characterizes that the seed is planted; the idea is conceived. Seeding explicitly captures the pre-market, foundational R&D, and core product / technology validation phase. It’s about proving an idea and its technical feasibility before commercial launch. This is required to capture the journey of the product from its inception. At the seeding stage, there are limited market validations, as the product might still be in a conceptual or prototype development phase.

- Sapling Stage – characterizes that the seedling sprouts; it’s a nascent plant with visible form. Sapling stage separates the initial product launch and early adopter acquisition from the core R&D. It’s about finding initial product-market fit and validating the core value proposition with real users. Developing the alpha or beta versions of the product or a Minimum Viable Product (MVP) to test its working capabilities. The focus shifts to getting initial users or clients, testing hypotheses about market fit, and refining the product based on early feedback. At this level, the sales (or market share) could be extremely low to moderately low and the growth rate will be high to extremely high.

Growth: This phase is divided into Climber and Blooming.

- Climber Stage – characterizes that the plant is vigorously growing upwards, reaching for light. Once the product gets ready at the sapling stage, it could have two possibilities. Either it will gain success or fail to attract its customers. So as per the first possibilities, the product is developed in such a way that it’s market fit, technologically sound, and efficient to fulfill the customer demand. The climber stage is first successful step towards future growth. At this stage, the sales (or market share) could be low and the growth rate apparently high.

- Blooming Stage – characterizes that the flower is fully open, showcasing its beauty and attracting attention and conveys greater visibility. Once the product take a positive leap from the climber stage, it’s time to grow further with technology and market acceptance in the blooming stage, and it is available for various industries and regions. At this stage, the sales (or market share) and the growth rate could be moderate.

Maturity: This phase transitions into Fruit and Oak.

- Fruit Stage – characterizes that the plant bears fruit; the product delivers tangible value and is widely adopted. Fruit signifies the period where the product is consistently profitable and valued by the market. At this stage, the sales (or market share) could be high and the growth rate seemingly low to moderate.

- Oak Stage – characterizes that the mighty oak stands strong, deeply rooted and enduring. Oak represents products that defy typical maturity curves by continuously innovating and maintaining market dominance. They avoid stagnation by reinventing themselves or their surrounding ecosystem. At this stage, sales (or market share) values should be in the high to very high range, whereas the growth rate could be low.

Decline: This final phase is classified as Creeper and Snag.

- Creeper Stage – characterizes a plant that struggles to grow continually, instead sprawling on the ground or being overshadowed. It’s an early warning of underperformance where the market fails to recognize or adopt the product. Single – ve growth rate doesn’t define that the product is going into the decline stage, that – ve growth can be applicable for every product due to market disturbance, which will stay for a smaller run. The creeper stage is a first-level warning before it goes into the snag stage. There is always a scope to revive from the creeper stage and gain a positive growth rate.

- Snag Stage – characterizes that the tree becomes a “snag”—a dead or dying tree, losing its leaves, rotting. Snag clearly defines the traditional “Decline” stage because the market demand of that product are diminishing. Their growth rate should have a consistent negative value irrespective of the sale (or market share) values.

Figure 2: 8-stage XLM and possible product journey paths

The XLM’s Value for Today’s Business and Marketing

The XLM framework is an essential tool for navigating the complexities of modern markets. Its analytical approach directly impacts business decision-making and marketing activities:

- Strategic Decision-Making: By pinpointing a product’s precise stage, managers can make data-driven decisions. For a product in the Seeding or Sapling phase, the strategy should focus on aggressive investment and market entry. For a product in the Fruit or Oak stage, the focus shifts to maximizing profitability and defending market share. Conversely, for products in the Creeper or Snag stages, the decision shifts to either revitalizing the product or planning a graceful exit to minimize losses.

- Marketing Activities: The XLM provides clear guidance for marketing teams. In the Climber and Blooming stages, marketing efforts should be focused on expanding distribution, building brand loyalty, and fending off competitors. In the Fruit or Oak stage, marketing efforts should be on customer retention, product extensions, and leveraging a strong brand reputation. The framework’s ability to compare multiple products on a single matrix is a game-changer for competitive analysis, allowing teams to proactively respond to competitors’ movements.

XLM for Strategic Partnerships and M&A

The XLM framework’s analytical power extends beyond internal product management to provide a critical lens for Mergers & Acquisitions (M&A), and for identifying the right partners for growth, such as distributors, solution providers, and investor firms.

- Mergers & Acquisitions: When considering an acquisition, the XLM helps you identify a target that has a complementary product portfolio. A company with products in the “Climber” or “Blooming” stages, for instance, might be an ideal acquisition for a larger firm in the “Oak” stage. The acquirer can inject capital and leverage its extensive distribution channels to accelerate the growth of the target’s promising products, creating significant synergy and value. The XLM is also a powerful tool for due diligence, helping a potential buyer differentiate between a product that is simply underperforming due to poor management (Creeper stage) and one that is in terminal decline due to diminishing market demand (Snag stage). This distinction is vital for accurate valuation and for mitigating the risk of a “bad” acquisition.

- Distributors: A distributor’s success depends on the vitality of the products in its portfolio. The XLM provides a clear way to evaluate potential partners. A distributor can actively seek partnerships with companies whose products are in the high-growth “Climber” or “Blooming” stages. By providing effective distribution, the distributor helps the partner accelerate their growth and in turn, secures a profitable stream of new business for themselves. A distributor can also look for a “Fruit” or “Oak” stage product to add a stable, low-risk element to their portfolio.

- Investor Firms: For a venture capital or private equity firm, the XLM provides a unique, product-centric approach to due diligence. Instead of relying solely on financial projections, a firm can use the XLM to assess the true health of a target company’s product portfolio. This can help them:

- Identify Hidden Gems: An investor can spot a promising product in the “Sapling” stage that has high potential but lacks the capital to grow

- Inform Investment Strategy: The XLM can help an investor firm determine if its core competencies align with the needs of the target company. For example, a firm specializing in operational efficiency might focus on an acquisition in the “Fruit” stage that needs help optimizing its supply chain to boost profitability.

- Plan the Exit Strategy: By understanding a product’s XLM position, investors can better plan their exit. A product in the “Blooming” or “Fruit” stage, for instance, could be positioned for a strategic sale to a larger company looking to add a growth engine to its own portfolio.

In today’s and tomorrow’s business landscape, where product lifecycles can be incredibly short and competition is fierce, the X-Lifecycle Matrix provides a powerful, analytical model to guide strategy. It moves beyond qualitative assumptions, offering a data-driven path for making informed decisions and ensuring products can thrive in a modern competitive environment.

Ready to transform your product strategy? Connect with us to explore the XLM and SMART Matrix™ frameworks.